Measure to Improve - Professional Services

If you don't measure it, you don't improve. KPIs give you a reliable way of measuring your business performance quickly every month.

This article looks at KPIs for a professional services business, not selling physical products.

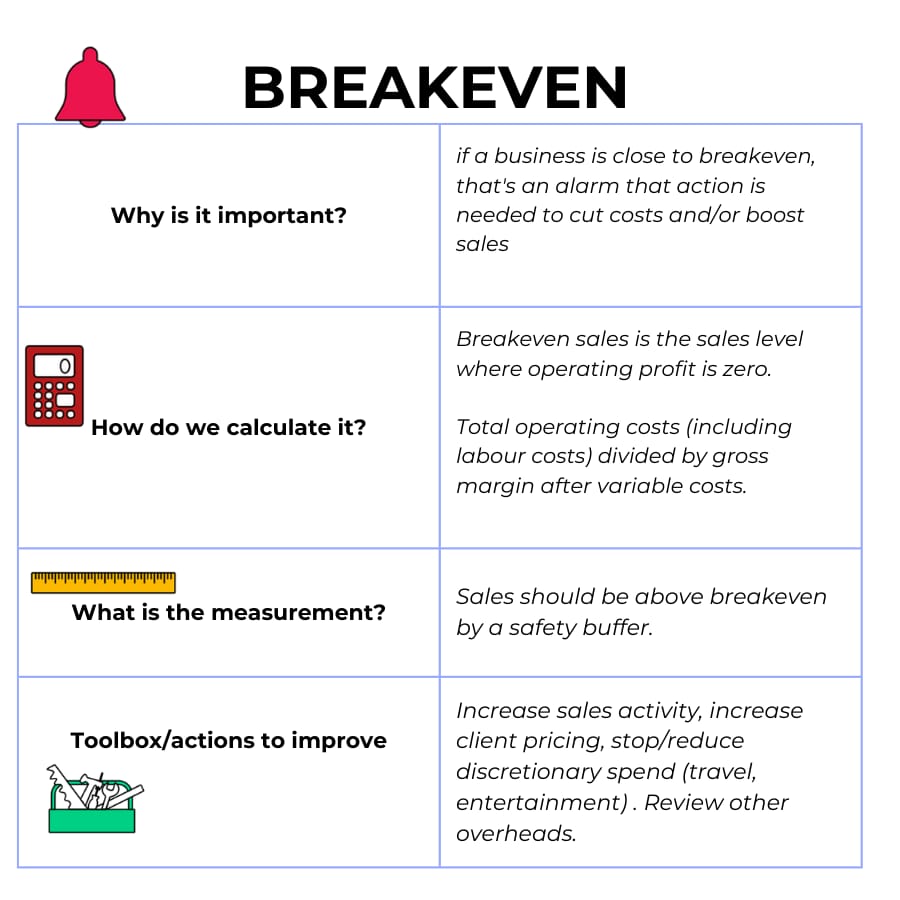

1.Sales

Sales are the starting point of profits and cash flow - the lifeblood of the business.

Sales for a professional services business can be measured in a number of ways:

Branches or divisions - a law firm may have different teams dealing with Employment Law, Corporate Law and Real Estate

People and teams - a team should have an overall target and the individual team members should have their own sales targets

Customers or segments - measure sales per client/customer as well as the client market segment

Sales are measured excluding sales taxes collected (GST in Australia, VAT in Britain, South Africa).

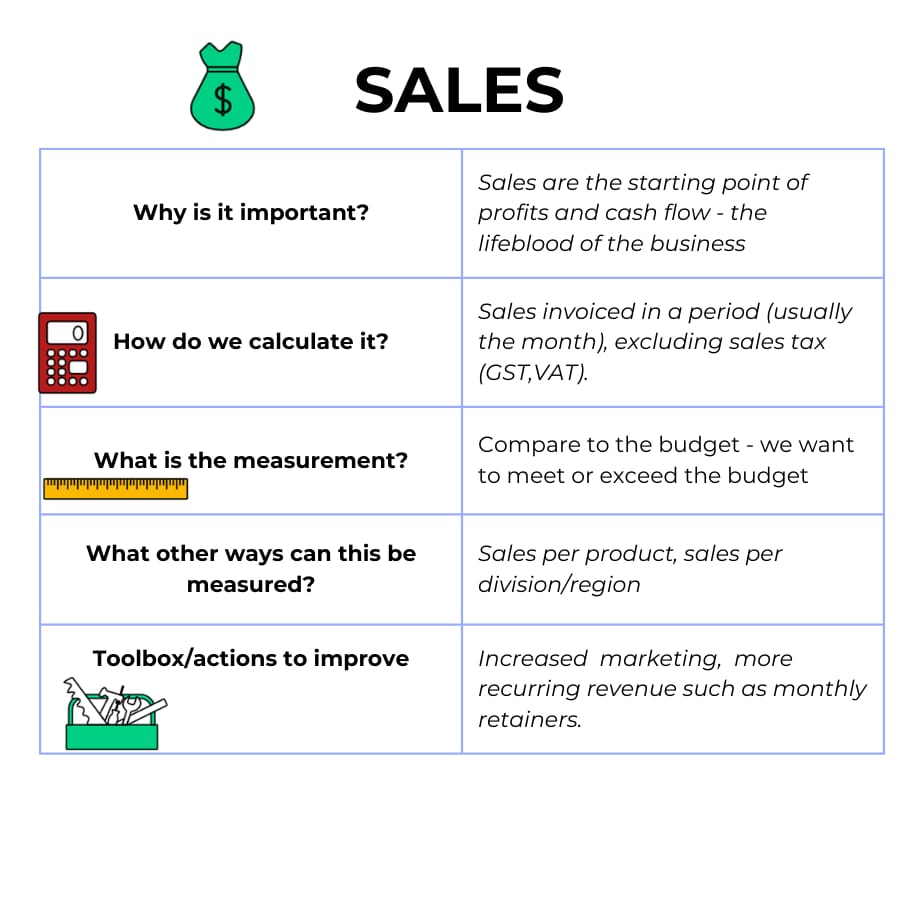

2.Gross profit

You may be achieving high sales but you need to take into account direct costs to generate the sales.

Gross profit = Sales minus Direct Costs (excluding labour).

Direct costs for a professional services business could be:

Subcontractors - an architectural firm may use subcontractors such as interior designers to carry out their brief

Travel and accommodation - an engineering team may need to travel to site to oversee a project.

Consultants or other professionals - a law firm may use expert witnesses. Environmental scientists may use laboratories to test samples.

It's important to measure the gross profit percentage, not only the dollar value.

Gross profit should be measured in the same categories as sales - by division, team and individual, client and client category.

The gross profit on a certain client or category may be higher or lower than the overall average, so it's important to look at gross profit in more detail.

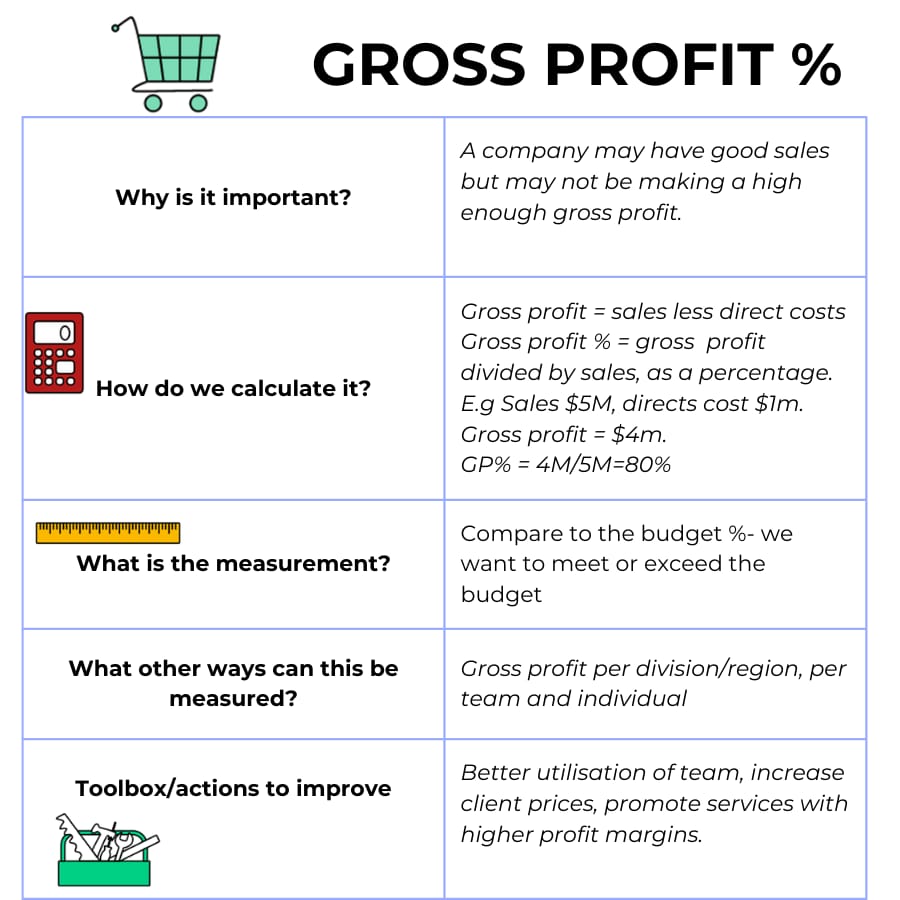

3.Labour Efficiency

The biggest cost in professional services is labour. Professional services firms sell time, in comparison to retailers or wholesalers who sell products.

How much revenue, after accounting for direct costs, do employees generate?

Put it another way: How much gross profit do employees generate?

Labour Efficiency is calculated as follows:

Gross profit (sales less direct costs)

divided by

Employee costs. (All employee costs need to be included - like 401k in the US or superannuation in Australia, medical insurance, company contributions to payroll taxes, leave etc.)

Rule of 3

A rough labour efficiency metric is 3. This means an employee should generate 3 times their costs in gross profit.

Example: an employee earning $70 000 should generate $210 000 in gross profit.

The logic is :

1 x employee cost = employee cost - salary, pension (401k/superannuation), insurance, payroll taxes

1 x employee cost = overheads (rent, insurance, IT & software costs, etc.)

1 x employee cost = profit

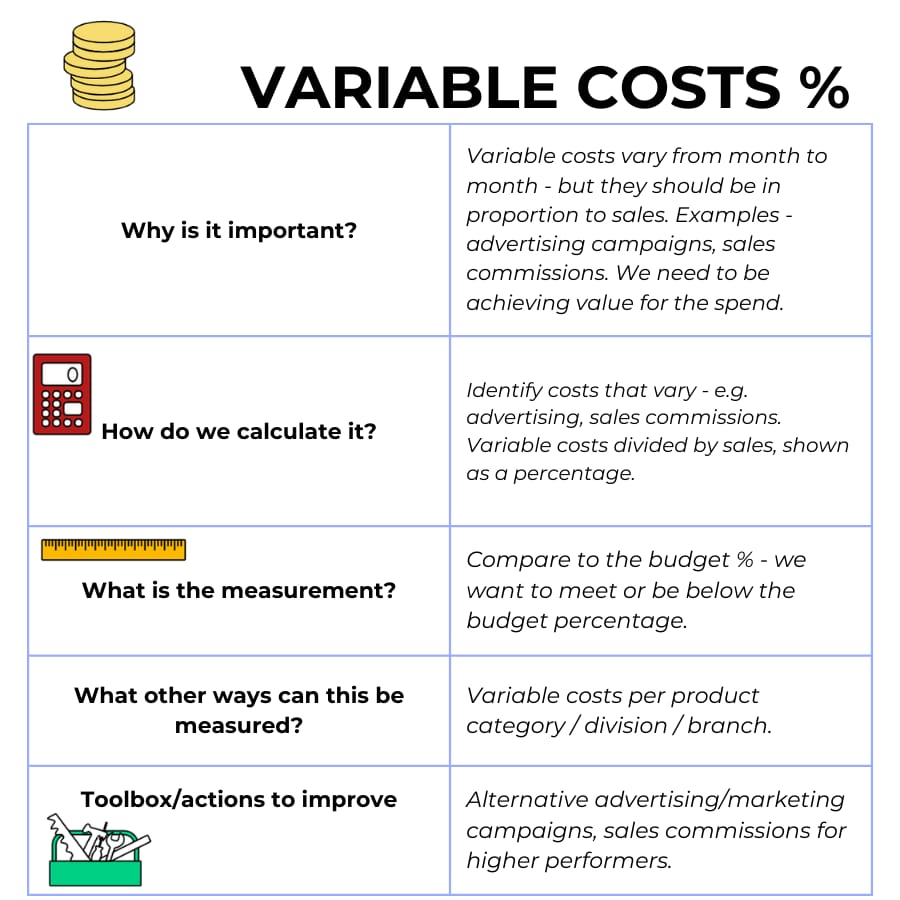

4.Variable Costs

Variable costs change from month to month and are often related to sales activities - advertising campaigns, sales bonuses or commission etc.

Why measure the percentage and not the dollar value? Because the increase in spend should lead to an increase in sales.

Our aim could be to spend $1 and get $3 in sales - that is a ratio of 1/3 = 33% of sales.

An increase in dollar spend is not bad if we get the proportional increase in sales.

If we are spending and not seeing the increase in sales, we aren't getting any bang for buck (or return on investment).

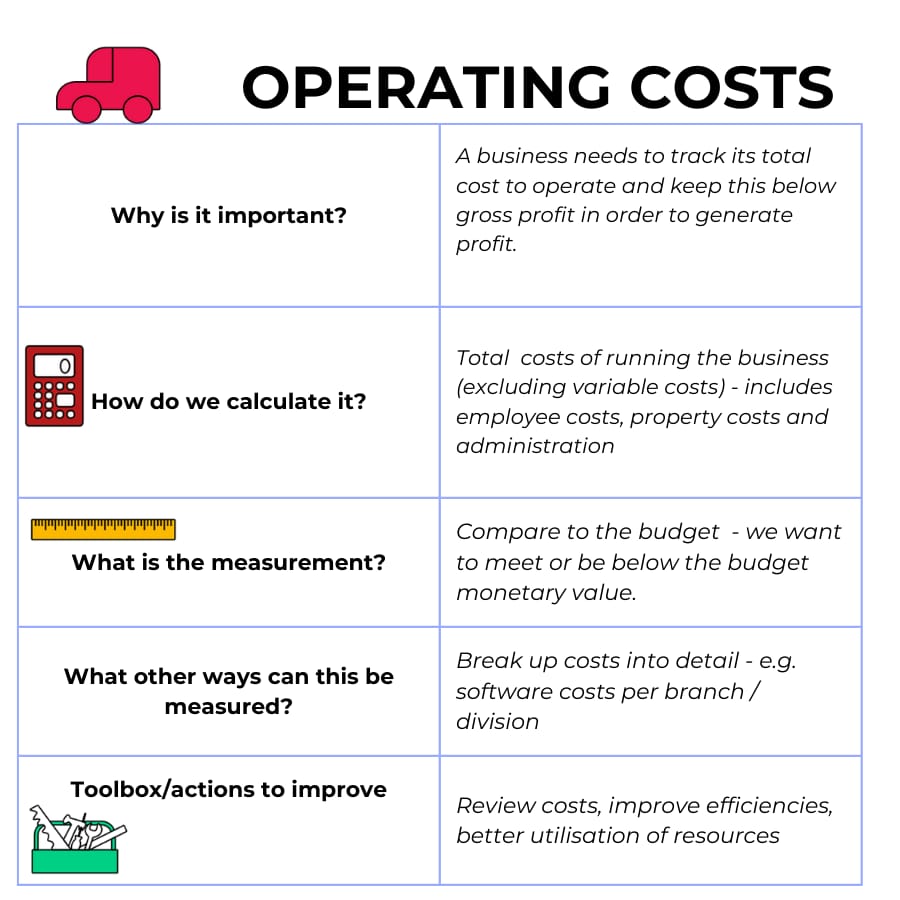

5.Fixed Operating Costs

Operating costs or running costs need to be controlled and kept within budget in order for the business to be profitable.

Costs should be analysed per division or branch to see that all areas are within budget.

Operating costs are also referred to as overheads. Overheads often need to be apportioned to a division.

Operating costs can be apportioned in a number of ways, for example:

Rent and property costs (electricity, maintenance) - can be allocated based on floor area or number of people in a building

Insurance - can be apportioned based on revenue

Software costs - divided by number of workstations or a charge per person

6. Operating Profit

Ultimately, a business exists to be profitable.

Operating profit is the most important measure of profitability - measure it in dollar value as well as percentage of sales.

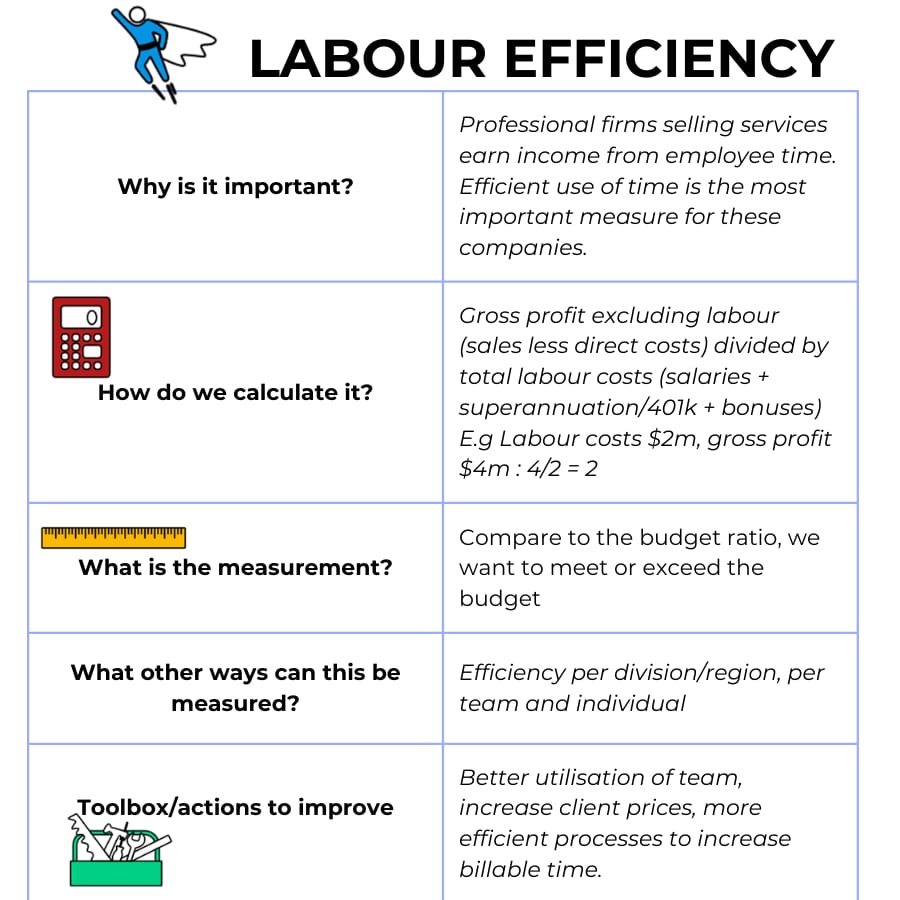

7. Breakeven

Breakeven means the sales level where profit = zero. In other words, all costs are covered, but the business makes no money.

It's good to know that number - sales should be far above this to be safe.